Markets go up and down, but your income shouldn’t.

When you retire, the financial game changes. You’re no longer saving for “someday”—you’re living it. And while the market may still move in unpredictable ways, your income should remain as steady and reliable as your morning cup of coffee.

That’s why “bulletproofing” your retirement portfolio is so important.

This article is about creating financial peace of mind. It’s not about chasing hot stocks or trying to time the market. It’s about building a resilient portfolio that can handle storms, sidestep surprises, and keep your retirement income flowing, no matter what the market is doing.

Let’s dive into the key strategies to keep your portfolio strong and steady—so you can enjoy retirement without watching the stock ticker every day.

Why Bulletproofing Matters in Retirement

When you’re working, a downturn in the market might just be a bump in the road. But in retirement, those bumps can feel like craters—especially if you’re withdrawing money while your investments are down.

This is called sequence of returns risk, and it can derail a retirement plan faster than you might think.

That’s why building a portfolio that can withstand market shocks—and still pay the bills—is so important.

Real-Life Example: Meet Robert and Joan

Robert and Joan retired in 2008, just as the Great Recession hit. Their entire portfolio was in a mix of U.S. stocks and a few bond funds—nothing else. As markets crashed, they were forced to sell investments at steep losses just to make ends meet.

By 2012, their nest egg had shrunk by almost 40%.

Compare that to their neighbors, Dave and Linda, who had a more balanced portfolio and followed a system that included a cash cushion, diversified income sources, and regular rebalancing. Their portfolio also took a hit—but they didn’t have to sell a single stock during the downturn. Today, they’re still living comfortably off their investments.

What made the difference?

Planning. Structure. Flexibility.

Let’s look at how to build that kind of bulletproof plan.

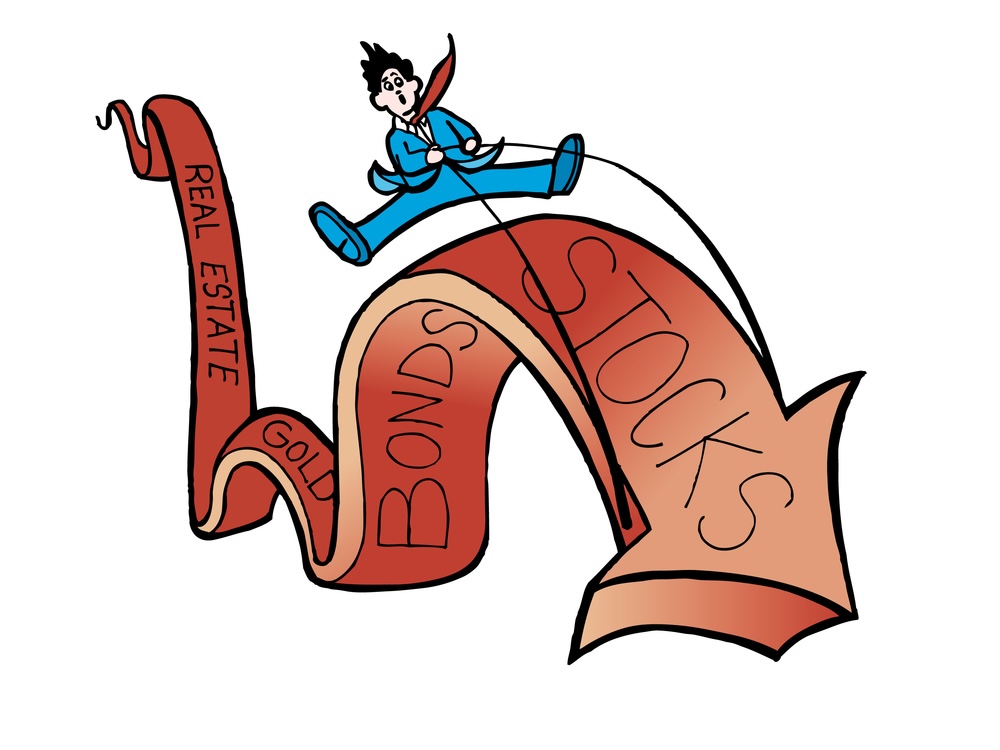

Strategy #1: Diversify Your Portfolio

Diversification is more than just a buzzword. It’s one of the simplest, most powerful ways to reduce risk in retirement.

Instead of putting all your eggs in one basket, diversification spreads your money across different asset types—so if one area stumbles, another can pick up the slack.

Here’s how to diversify in retirement:

Mix stocks and bonds: Stocks for long-term growth, bonds for stability and income.

Add dividend-paying ETFs: These can provide steady income even when the market is volatile.

Include real estate investments (like REITs): These can produce regular income and hedge against inflation.

Use international exposure: Markets outside the U.S. don’t always move in lockstep.

Consider alternatives: Such as preferred stocks, utilities, or energy pipelines for income stability.

When your portfolio includes a broad mix of investments, you’re not depending on any one thing to carry the load.

Strategy #2: Build a Cash Cushion

A cash cushion is exactly what it sounds like: a pile of safe, liquid money set aside to cover near-term expenses—usually one to three years’ worth.

This is your personal “shock absorber” during turbulent markets.

Benefits of a cash cushion:

✅ Lets you avoid selling investments when the market is down.

✅ Helps cover living expenses without worry.

✅ Buys you time to let the rest of your portfolio recover.

Good sources for your cash cushion include:

High-yield savings accounts

Money market accounts

Treasury bills

Short-term CDs

This cash buffer is your first line of defense—and it can prevent panic-driven decisions during a downturn.

Strategy #3: Rebalance Regularly

Over time, your investments shift. Stocks rise, bonds fall—or vice versa—and your original mix of assets drifts out of alignment. That’s why rebalancing is key.

Rebalancing means selling a bit of what’s grown and buying more of what hasn’t, to restore your target allocation.

It might seem counterintuitive, but rebalancing:

✅ Reduces risk by preventing overexposure to stocks

✅ Forces you to sell high and buy low

✅ Keeps your portfolio aligned with your goals

Most retirees rebalance annually or semiannually. Some use a rule like: rebalance when any major category is more than 5% off target.

The best part? You don’t have to guess. It’s systematic and emotion-free.

Strategy #4: Set Up Income Streams You Can Count On

While market-based investments are great for long-term growth, it’s wise to pair them with guaranteed income sources that don’t rely on the stock market.

Reliable income sources include:

Social Security (still the cornerstone for most retirees)

Pensions (if you’re lucky enough to have one)

Annuities (for those who want a personal pension)

Bond ladders or fixed-income ETFs

Dividend-paying stocks and funds

The idea is simple: cover your essential expenses (housing, food, insurance) with guaranteed or predictable income, so you never have to worry about market swings affecting your ability to pay the bills.

Strategy #5: Use the Bucket System

One of the best ways to bulletproof your retirement is to organize your portfolio into three “buckets” based on when you’ll need the money.

This strategy helps you weather storms while still allowing long-term growth.

Here’s how it works:

🪣 Bucket 1 – Short-Term (0–3 years)

Purpose: Cash for living expenses

Investments: Savings, CDs, money market funds

Goal: Safety and liquidity

🪣 Bucket 2 – Mid-Term (3–10 years)

Purpose: Income for the medium term

Investments: Bonds, preferred stocks, dividend ETFs

Goal: Moderate income and low volatility

🪣 Bucket 3 – Long-Term (10+ years)

Purpose: Growth for the future

Investments: Stocks, equity ETFs, REITs

Goal: Beat inflation and grow your portfolio

By the time Bucket 1 is empty, Bucket 2 is ready to refill it. Meanwhile, Bucket 3 is left untouched to ride out the market.

Real-Life Example: Meet Barbara

Barbara retired at 67 with $700,000 saved. Instead of just drawing 4% per year and hoping for the best, she adopted a bucket strategy.

$75,000 went into a cash cushion (Bucket 1)

$275,000 into a mix of bonds and dividend ETFs (Bucket 2)

$350,000 into growth stocks and long-term investments (Bucket 3)

When the market dipped during a rough year, Barbara didn’t panic. Her daily expenses were already covered from Bucket 1, and her growth investments in Bucket 3 had years to recover. Today, she still draws the same income—and sleeps soundly knowing her money is organized and protected.

Strategy #6: Keep Your Emotions in Check

This one isn’t about spreadsheets or charts—it’s about your mindset.

Market drops are normal, not personal. A bulletproof portfolio is designed to ride out storms.

That’s why it’s so important to:

Stay committed to your plan

Avoid making impulsive decisions

Work with a financial advisor who supports your long-term goals

The market will go down from time to time—but it always recovers. The key is not letting short-term fear derail your long-term peace.

Quick Recap: Bulletproofing Basics

Let’s summarize how to protect your retirement portfolio:

✅ Diversify across asset types and sectors

✅ Keep a 1–3 year cash cushion

✅ Rebalance regularly to stay aligned

✅ Set up reliable income streams

✅ Use the bucket strategy for stability and growth

✅ Stay calm and avoid emotional decisions

Each of these pieces works together like armor—protecting your income, preserving your capital, and giving you the confidence to enjoy the retirement you’ve earned.

Closing Thoughts: Retirement Shouldn’t Be a Rollercoaster

You’ve worked your whole life to build your savings. Now it’s time to let that money work for you—without unnecessary worry.

By bulletproofing your retirement portfolio, you’re not just avoiding losses. You’re building a plan that lets you enjoy the freedom, flexibility, and peace of mind that retirement should bring.

You don’t need to predict the market. You just need a smart, structured plan that lets you thrive—no matter what.

P.S. This article is an excerpt from my book “The Bucket Strategy for Retirees: The Proven System to Avoid Running Out of Money in Retirement”. If you’d like a step-by-step guide to structuring your retirement income using the bucket strategy, you can find the full book on Amazon.com, available in Kindle and paperback editions.